|

Financials

Financials

First Half Financial Statements And Dividend Announcement 2025

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

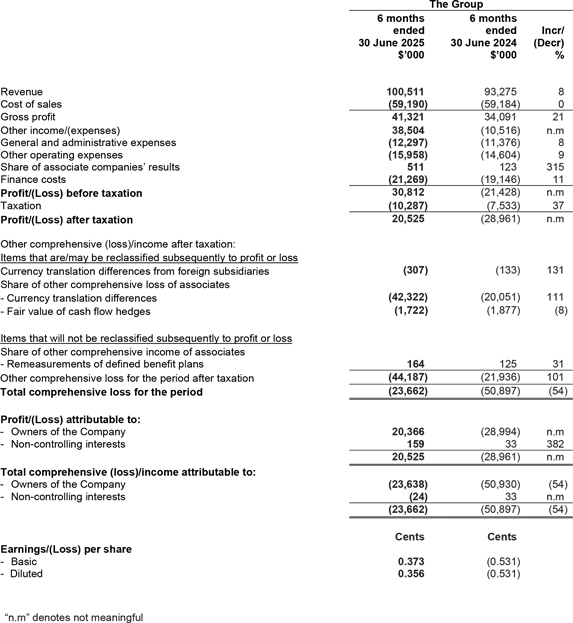

Condensed interim consolidated statement of comprehensive income

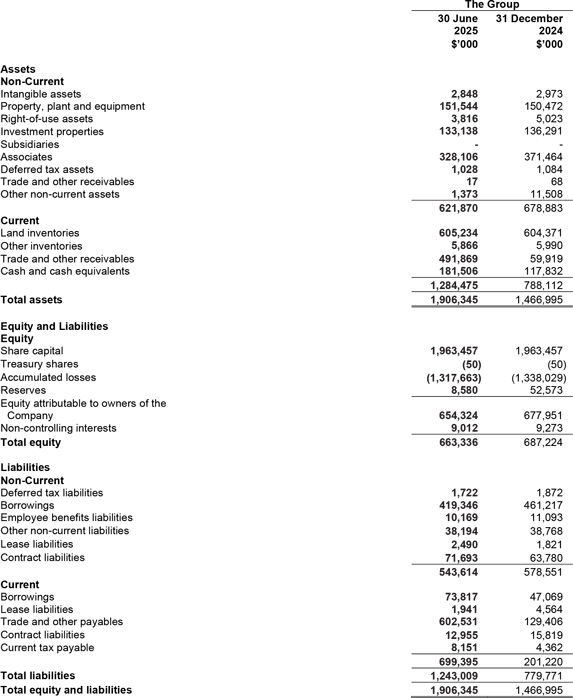

Condensed interim consolidated statement of financial position

Review of Performance

Half Year 2025 (1H 2025) vs. Half Year 2024 (1H 2024)

Profit & Loss

The Group reported revenue of S$100.5 million for 1H 2025, representing an increase of 7.7% compared to S$93.3 million in the corresponding period. The increase was mainly attributable to higher contributions from the industrial parks segment, driven by increased occupancy, improved rental yields, and the completion of new factory units. These led to stronger revenue from industrial leases, related income, and utilities. In addition, revenue from ferry services and tourism-related activities improved in line with the higher number of tourist arrivals during the period.

In tandem with the increased revenue and improved margins, the Group's cost of sales amounted to S$59.2 million in both 1H 2024 and 1H 2025. The Group's cost of sales to revenue ratio was 0.59 in 1H 2025, comparable to 0.63 in the corresponding period. As a result, the Group's gross profit improved from S$34.1 million in 1H 2024 to S$41.3 million in 1H 2025.

The Group's “other income/(expenses)” was S$38.5 million income compared to S$10.5 million expenses in 1H 2024. This was mainly due to the foreign exchange gain of S$34.2 million in 1H 2025 compared to the foreign exchange loss of S$12.4 million in 1H 2024. The foreign exchange gain was mainly from translating the Group's USD-denominated borrowings as the US dollar depreciated sharply against the Singapore dollar in 1H 2025.

The Group's “general and administrative expenses” were S$12.3 million, compared to S$11.4 million in 1H 2024. The increase was mainly due to higher manpower-related expenses and business development expenses.

The Group's “other operating expenses” were S$16.0 million, compared to S$14.6 million in 1H 2025. The increase was mainly due to higher manpower and repair and maintenance expenses.

The Group's share of profit from associate companies increased from S$0.1 million in 1H 2024 to S$0.5 million in 1H 2025, mainly due to the absence of prior-period adjustments for unrealised intragroup profits.

The Group's “finance costs” increased to S$21.3 million in 1H 2025, compared to S$19.1 million in 1H 2024. This was mainly due to the higher bank borrowings.

The Group reported a net profit attributable to owners of the Company of S$20.4 million in 1H 2025, a reversal from the net loss of S$29.0 million recorded in 1H 2024.

Financial position

As of 30 June 2025, the Group's total assets were S$1,906.3 million, compared to S$1,467.0 million at the end of the previous year.

Property, plant, and equipment increased by S$1.0 million due to capital expenditures on building, infrastructure, and construction related to new factories, partially offset by depreciation. The Group's right-of-use assets and investment properties decreased by S$4.4 million due to depreciation.

The Group's associates decreased by S$43.4 million due to the translation loss of S$41.3 million on the translation of PT IMAS's results and net assets from the Indonesian Rupiah to the Singapore dollar, where the Indonesian Rupiah weakened as of 30 June 2025.

The Group's other non-current assets decreased by S$10.1 million, mainly due to the recognition of prepaid taxes as expenses during the period and the reclassification of the other receivables, which were advance payments for the project development, to the appropriate asset categories.

The Group's trade receivables increased by S$7.6 million, which is in line with higher revenue. Other receivables increased by S$424.8 million, of which S$429.4 million increase was due to advance payments and deposits for the Group's investments in new power plants and S$2.8 million increase was due to advances paid to contractors for the construction of new industrial factories, the development of the airport project, the construction of resort-related facilities and the Solar PV project. These increases were partially offset by a decrease of S$7.4 million in amounts owing from related parties.

As of 30 June 2025, the Group's total liabilities were S$1,243.0 million, compared to S$779.8 million at the previous year's end. The Group's borrowings decreased by S$15.1 million due to loan repayments and the impact of foreign exchange translation on the US outstanding amounts, where the USD has depreciated against the Singapore dollar.

The Group's trade and other payables increased by S$473.1 million, mainly due to (i) to contractors and suppliers working on constructing new factories in the Group's industrial parks and the ongoing development in Bintan Resort (ii) advances received from the investor intending to participate in the Group's investment in new power plants which will be subsequently reclassified when the appropriate funding structure is finalised and (iii) increased rental and electricity deposits received from the new industrial park tenants.

The Group's lease liabilities decreased by S$2.0 million, mainly due to the payment of the principal portion of the lease liabilities. The Group's contract liabilities increased by S$5.0 million, mainly due to higher rental payments received in advance from the industrial park tenants and receipt of advances from travel agents for ferry services and tour packages to Bintan Resorts.

Cash Flow

For the period under review, the net cash inflow generated from operating activities was S$73.5 million, compared to the net cash outflow of S$22.8 million used in the previous period. The net cash inflow from operating activities was primarily driven by higher advances from the investor intending to participate in the Group's investment in new power plants and lower income tax payments during the current period.

The Group recorded a net cash outflow of S$11.7 million from investing activities, compared to S$49.2 million in the prior period. The decrease was primarily attributable to lower capital expenditure for the construction of new factories in the industrial parks and the absence of new investments in the current period.

The Group recorded a net cash inflow of S$2.7 million from financing activities, compared to S$63.3 million in the prior period. The lower net cash inflow in the current period was mainly attributable to reduced net borrowings, lower drawdowns from the facilities and the repayment of the principal portion of lease liabilities.

The Group's cash and cash equivalents in the statement of cash flow were S$162.1 million as of 30 June 2025, compared with S$97.7 million as of 31 December 2024.

Liquidity and financial resources

For the financial period ended 30 June 2025, the Group's working capital was mainly financed by internal resources generated from the operation, whilst the Group's capital expenditure in relation to the construction of new factories, expansion of the industrial parks and new investment/development was financed by advance lease payments from the tenants and bank borrowings. As of 30 June 2025, the cash and cash equivalents in the statement of financial position were S$181.5 million, which increased by 54% compared to S$117.8 million as of 31 December 2024. The Group's current ratio was approximately 1.8 times (31 December 2024 - 3.9 times).

As of 30 June 2025, the Group's borrowings were S$493.2 million. Borrowings due within one year were S$73.8 million (31 December 2024 - S$47.1 million), and borrowings due after one year were S$419.4 million (31 December 2024 - S$461.2 million). Out of S$73.8 million in borrowings due within one year, S$35 million comprises the banks' Revolving Credit Facilities (RCF). These facilities allow the Group to renew or extend, effectively deferring the need for immediate repayment within the next 12 months.

The Group's borrowings were denominated in Singapore and United States dollars, with interest rates ranging from 6.06% to 8.10%. The Group's total debts, including lease liabilities, were S$497.6 million (31 December 2024 - S$514.7 million). As of 30 June 2025, the Group's gearing ratio was 0.8 times (31 December 2024 - 0.7 times, which was calculated on the Group's total debts to total shareholders' equity (including non-controlling interests). The increase was primarily due to lower total shareholders' equity.

Commentary On Current Year Prospects

The Group continues to attract new tenants from the regions to its industrial parks, as companies pursue diversification strategies and seek alternative manufacturing locations. With the contributions from newly completed factory units, the Group is confident that revenue from the industrial parks and utilities segments will surpass previous years' levels. Encouraged by the sustained demand, the Group remains optimistic that this positive trend in industrial space take-up will continue. In line with this outlook, the Group has commenced new phases of expansion to support future growth. As part of this expansion plan, the Company has announced its intention to invest in new power plants to meet growing energy demand and further diversify its power generation portfolio.

Tourist arrivals for the first half of 2025 showed a promising recovery, registering a 23% increase compared to the same period in 2024. The Group anticipates an even stronger performance in the second half of the year, supported by a robust line-up of sporting and large-scale events scheduled to take place at Bintan Resorts. The Group expects tourist arrivals to reach pre-pandemic levels by the end of 2026. The Group will continue pursuing new developments and enhancing its product offerings to accelerate recovery.