|

Financials

Financials

Full Year Financial Statements And Dividend Announcement 2024

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

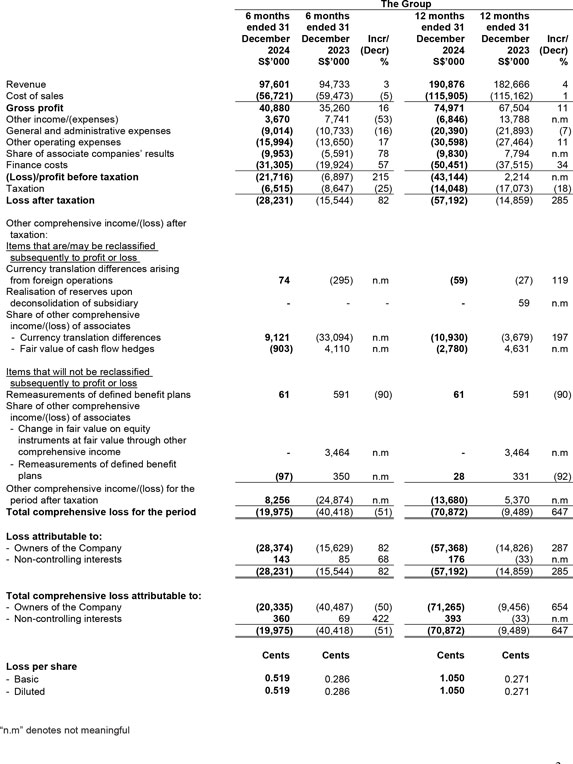

Condensed interim consolidated statement of comprehensive income

Condensed interim consolidated statement of financial position

Review of Performance

Profit or Loss

2H 2024 vs. 2H 2023

The Group's revenue was S$97.6 million, 3.0% higher than 2H 2023's S$94.7 million. This was mainly due to higher revenue from the industrial park and utilities segments, driven by higher industrial leases, new hotel openings, and tourist-related activities in Bintan Resort.

The Group's cost of sales decreased from S$59.5 million in 2H 2023 to 2H 2024's S$56.7 million due to lower depreciation expenses. The Group's cost of sales to revenue ratio was 0.58 in 2H 2024 compared to 0.63 in 2H 2023. The Group's gross profit increased from S$35.3 million in 2H 2023 to S$40.9 million in 2H 2024.

The Group's “other income” was S$3.7 million, compared to S$7.7 million in 2H 2023. This was mainly due to a lower foreign exchange gain of S$0.9 million in 2H 2024 compared to S$7.0 million in 2H 2023.

The Group's “general and administrative expenses” of S$9.0 million were lower than 2H 2023's S$10.7 million, mainly due to lower manpower-related costs and business development expenses.

The Group's “other operating expenses” were higher at S$16.0 million than 2H 2023's S$13.7 million. This was mainly due to higher manpower-related costs, professional fees, repair and maintenance, and marketing-related expenses.

The Group's share of loss from its associate companies was S$10.0 million in 2H 2024, compared to S$5.6 million in 2H 2023. This was primarily due to PT IMAS's S$10.1 million losses in 2H 2024, compared to S$6.0 million in 2H 2023. Despite increased revenue and gross profit in 2H 2024, PT IMAS was impacted by higher financing costs.

Group's “finance costs” were S$31.3 million, higher than 2H 2023's S$19.9 million, mainly due to a higher interest rate on external bank borrowings and the one-time non-cash write-off of S$8.4 million on unamortised transaction costs incurred from the previous borrowings due to refinancing.

The Group reported a net loss attributable to the Company's owners of S$28.4 million, compared to 2H 2023's S$15.6 million.

12 Months 2024 (FY2024) vs. 12 Months 2023 (FY2023)

The Group revenue was S$190.9 million, 4.5% higher than FY2023's S$182.7 million. This increase was mainly due to higher revenue from the industrial park and utilities segments, driven by higher industrial leases, new hotel openings, and tourism-related activities in Bintan Resort. The property development segment also contributed S$1.7 million to the increase.

While the Group's cost of sales increased along with higher revenue, the increase was marginal from S$115.2 million in FY2023 to S$115.9 million in FY2024 due to lower depreciation expenses. The Group's cost of sales to revenue ratio was 0.61 in FY2024, comparable to 0.63 in the corresponding year. The Group's gross profit increased from S$67.5 million in FY2023 to S$75.0 million in FY2024.

The Group's “other (expenses)/income” was S$6.8 million expenses compared to S$13.8 million income in FY2023. This was mainly due to the foreign exchange loss of S$11.5 million in FY2024 compared to the gain of S$11.3 million in FY2023. The foreign exchange loss was mainly due to the repayment of the Group's previous US Dollar-denominated borrowings when the US Dollar appreciated against the Singapore Dollar at the time of repayment and the accounting for unrealised foreign exchange translation losses due to the strengthening of the US Dollar.

The Group's “general and administrative expenses” were S$20.4 million, compared to FY2023's S$21.9 million. This was mainly due to lower manpower-related costs and business development expenses.

The Group's “other operating expenses” were S$30.6 million compared to FY2023's S$27.5 million, mainly due to higher manpower-related costs, repair and maintenance, and marketing-related expenses.

The Group's share of results from its associated companies decreased from a profit of S$7.8 million in FY2023 to a loss of S$9.8 million, mainly due to:

- Including fair value gain on its investment properties, PT IMAS reported a net profit of S$9.3 million in FY2024

compared to S$55.3 million in FY2023. Excluding the fair value gain, PT IMAS reported a loss of S$14.7

million compared to a S$19.7 million profit in FY2023 due to:

- Gross profit decreased by S$23.8 million as revenue declined by S$82.3 million from S$2,550.7 million in FY2023 to FY2024's S$2,468.4 million, mainly due to lower truck and heavy-duty equipment sales;

- Financing costs increased by S$18.5 million from FY2023's S$189.7 million to FY2024's S$208.2 million, mainly due to higher external bank borrowing interest rates;

- Higher foreign exchange loss of S$8.4 million in FY2024 compared to S$4.1 million in FY2023; and

- Higher tax expenses due to the reversal of deferred tax assets following the expiration of certain tax losses.

The Group did not account for PT IMAS's fair value gain on its investment properties, as it adopted the cost method for measuring them. As a result, PT IMAS's contribution to the Group was a loss of S$9.8 million in FY2024, compared to a profit of S$7.2 million in FY2023. - Adjustment to the share of its associate's results to account for unrealised intragroup profit from transactions with the Group's associated company.

The Group's “finance costs” were S$50.5 million, higher than FY2023's S$37.5 million. This was mainly due to the higher external bank borrowings interest rates and a one-time non-cash write-off of S$8.4 million on the remaining unamortised transaction costs incurred from the previous borrowings due to refinancing.

The Group's net loss attributable to owners of the Company was S$57.4 million, compared to FY2023's S$14.8 million.

Financial position

As of 31 December 2024, the Group's total assets were S$1,456.6 million, compared to S$1,399.5 million at the end of the previous year.

The Group's intangible assets increased by S$2.9 million due to the acquisition of telecommunication software and systems. Investment properties increased by S$48.1 million due to capital expenditures on constructing new industrial buildings and related infrastructure, partially offset by depreciation. The Group's right-of-use assets and property, plant, and equipment decreased by S$12.4 million, mainly due to depreciation.

Notwithstanding the investment of S$16 million in a new associated company during the year, the Group's associates decreased by S$8.6 million due to the translation loss of S$10.7 million on the translation of PT IMAS's results and net assets from the Indonesian Rupiah to the Singapore dollar, where the Indonesian Rupiah weakened as of 31 December 2024.

The Group's trade receivables increased by S$1.5 million, which aligns with higher revenue. Other receivables increased by S$12.5 million, mainly due to the advances paid to contractors for the construction of new industrial factories, the development of infrastructure, the construction of resort-related facilities, the development of a Solar PV system, and a temporary bridging loan extended to an associated company.

The Group's other non-current assets increased by S$3.7 million, mainly due to advance payment for utilities development but partially offset by the realisation of prepaid taxes.

As of 31 December 2024, the Group's total liabilities were S$780.3 million, compared to S$651.8 million at the previous year's end. The Group's borrowings increased by S$125.9 million, mainly due to increased bank borrowings obtained to finance the Group's capital expenditures, investments, and working capital.

The Group's trade and other payables increased by S$6.3 million, mainly due to contractors and suppliers working on constructing new factories in the Group's industrial parks and the ongoing development in Bintan Resorts.

The Group's lease liabilities decreased by S$4.1 million, mainly due to the payment of the principal portion of the lease liabilities. The Group's other non-current liabilities increased by S$4.3 million, mainly due to the increased rental and electricity deposits from the industrial park tenants for the new factories.

The Group's contract liabilities decreased by S$0.7 million, mainly due to the recognition of rental revenue received in advance from the industrial park tenants and the travel agents for tour packages to Bintan Resorts.

Cash Flow

For the year under review, net cash outflow from operating activities was S$37.8 million compared to S$22.2 million generated from the previous year. The net cash outflow in operating activities was due to the payment of income tax and interest amounting to S$49.1 million in the current year.

The Group's net cash outflow from investing activities was S$80.7 million, compared to S$50.9 million in the previous year. This was mainly due to increased capital expenditures for the construction of new factories in our Industrial Parks and new investments.

The Group's net cash inflow of S$125.7 million from financing activities compared to S$7.3 million in the previous year. The net cash inflow in the current year was mainly due to the utilisation of the Group's new banking facilities obtained during the period but offset by the repayment of previous borrowings and payment of the principal portion of the lease liabilities.

The Group's cash and cash equivalents in the cash flow statement were S$97.7 million as of 31 December 2024, compared with S$90.6 million as of 31 December 2023.

Liquidity and financial resources

For the financial period ended 31 December 2024, the Group's working capital was mainly financed by internal resources generated from the operation, whilst the Group's capital expenditure in relation to the construction of new factories, expansion of the industrial parks and new investment was financed by advance lease payments from the tenants and bank borrowings. As of 31 December 2024, the cash and cash equivalents in the statement of financial position were S$117.8 million, which increased by 8% compared to S$109.1 million as of 31 December 2023. The Group's current ratio was approximately 3.9 times (31 December 2023 - 3.5 times).

As of 31 December 2024, the Group's borrowings were S$508.3 million. Borrowings due within one year were S$47.1 million (31 December 2023 - S$71.2 million), and borrowings due after one year were S$461.2 million (31 December 2023 - S$311.2 million). Out of S$47.1 in borrowings due within one year, S$13 million comprises the banks' Revolving Credit Facilities (RCF). These facilities allow the Group to renew or extend, effectively deferring the need for immediate repayment within the next 12 months.

The Group's borrowings were denominated in Singapore and United States dollars, with interest rates ranging from 6.58% to 8.82%. The Group's total debts, including lease liabilities, were S$514.6 million (31 December 2023 - S$392.9 million). As of 31 December 2024, the Group's gearing ratio was 0.8 times (31 December 2023 - 0.5 times, which was calculated on the Group's total debts to total shareholders' equity (including non-controlling interests). The increase was primarily due to increased bank borrowings to finance the capital expenditure and investment.

Commentary On Current Year Prospects

In 2024, the Group's industrial parks experienced strong growth, marked by an expansion in lettable areas and strong occupancy rates. An additional 116,400 sqm of industrial lettable space was added during the year, which was fully leased and achieved full occupancy. This expansion is expected to drive increases in rental-related and utilities revenue, with the full impact materialising in the years ahead as tenants commence their production. Meanwhile, the pipeline for new industrial space remains strong, supported by the continued diversification of supply chains in the region.

Tourist arrivals at Bintan Resorts have experienced subdued growth, with 2024 figures falling short of the Group's expectations, primarily due to regional factors. Several neighbouring countries have waived Visa requirements, making them more attractive to travellers, while Singaporeans, with strong Singapore dollar, are travelling to further destinations. On a positive note, tourist arrivals from China have surged by 35%, boosting overall visitor numbers. The Group is confident that tourist arrivals will see significant growth in 2025, driven by new hotel openings, exciting new attractions, and more large-scale events at Bintan Resorts.